China commodity prices for such materials as iron ore, steel rebar, coal and copper soared to record highs in May forcing the government to intervene and curb cost increases for consumers.

As the world’s largest manufacturer and construction market, China has been the main driver behind global metal markets for more than a decade.

From January to mid-May, prices for steel rebar, hot-rolled steel coil and copper rose more than 30% as construction and manufacturing expanded in the world’s largest consumer of metal.

Other vital industrial inputs including iron ore, thermal coal, sulphuric acid and glass also roser to record highs as consumption outpaced supply.

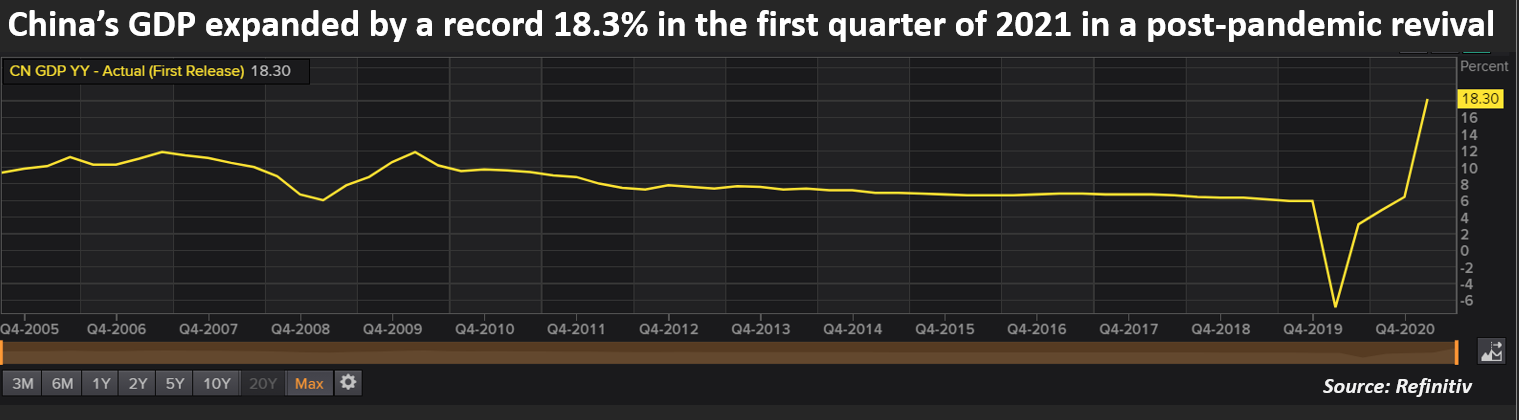

China’s economic recovery accelerated sharply in the first quarter of 2021 after the coronavirus lull in 2020

The huge government stimulus measures launched at the height of the COVID-19 lock-down last year spurred construction activity, while the world’s largest manufacturing base capitalised on booming demand for appliances, exercise equipment and machinery in locked-down countries around the world from mid-2020.

With rising raw material prices stoking fears of inflation, the government is urging coal producers to boost output while investigate behaviour that may be bidding up prices.

Regulators in Shanghai and the steel hub of Tangshan warned mills this month against price gouging, collusion and irregularities, and said they would close businesses of those disrupting market order.

China’s commodity price rises have been further exacerbated by global shipping rates. The Baltic Dry Index (BDI) – a bell weather for dry freight rates – surged to a 19-month high underpinned by excess demand and COVID affected supply.