And where would America’s traditional clients stand?

A Cold War could be emerging between the U.S. and China as the rhetoric out of Washington becomes increasingly belligerent according to media commentators. In fact, the relationship between the world’s two largest economies could be at its lowest point since the Nixon-Kissinger rapprochement of the 70s. Luckily, so far, both have refrained from escalating to a major blow-up but the ongoing fallout from the Corona Virus might threaten that.

Some had last year referred to increasingly frosty U.S.-China ties as a new Cold War, but that is an entirely inaccurate description. Firstly, the original Cold War was premised on (the largely U.S) notion that the Soviet Union posed an existential threat to the existence of Western Europe as a democratic alley and the was intent on the spread of Communism as an ideology around the world.

The current situation between China and the U.S. is fundamentally different. The conflict between Washington and Beijing is counterbalanced by the two nations’ economic interdependence. A dependence Washington never had with Moscow.

This extensive web of trade and investment relationships developed over the last three decades force the U.S. to counterbalance more extreme positions.

In fact, until recently even officials of the Trump administration did their best to play down sometimes overblown rhetoric.

But unfortunately, those mitigating factors are dissipating somewhat in the wake of the Corona Virus and the talk from Washington is becoming increasingly hostile.

As the devastation from Covid-19 accumulates in the U.S., arguably exposing the failure of decades of underinvestment in infrastructure, healthcare and the growth of the wealth gap, the number American fatalities is now nearly double that of the Vietnam War – a conflict that lasted longer than a decade.

And increasingly, voices in the U.S. government are turning to blame China with the view that the CCP should be held accountable for the devastation gaining ground. Those that support the view distrust China’s narrative (and the CCP in general) of the outbreak.

The problem is, this line of arguing is increasingly looking like a direct assault on the very nature of the CCP not just its handling of the Covid-19 Crisis. Whether this is simply election-year rhetoric remains to be seen. But Washington looks, and more importantly sounds, serious.

*****

On the Chinese side, the accusations are providing ammunition for the propaganda machine that claims the communist regime is superior to the disorganized Western democracies, pointing out how Western nations are still struggling to get a handle on the crisis and how a panicked Trump administration is using the Virus as part of a blame game; deflecting from their own societal shortcomings.

Either way, these are alarming signs at a time when the world most needs to pull together to tackle a problem that has no interest in borders, nationalities or ideologies.

*****

But so long as the two countries remain bound by the interlocking forces of globalization and their own interdependencies then there is a limit to how far this could go.

The problem is, the Pandemic could be at risk of undoing those ties and decoupling the economies. According to Reuters, the U.S. government is now considering all kinds of measures to lessen dependence on China including tax breaks for companies that relocate their production and procurement facilities across a broad range of sectors.

The US has already barred telecom provider Huawei from a stake in its 5G network and pressured its clients follow suite with varying degrees of success and looks like trying to push China out of all America considers ‘it’s sphere of influence.’ And could lead to serious consequences.

Perhaps lurking in the back of some policy maker’s mind’s in the U.S. is Xi Jinping’s bold declaration at the that:

“China will be a global superpower by 2050.”

CCP congress in October 2017

Since then Beijing has rolled out a strategically ambitious project through massive spending on military and civilian technologies.

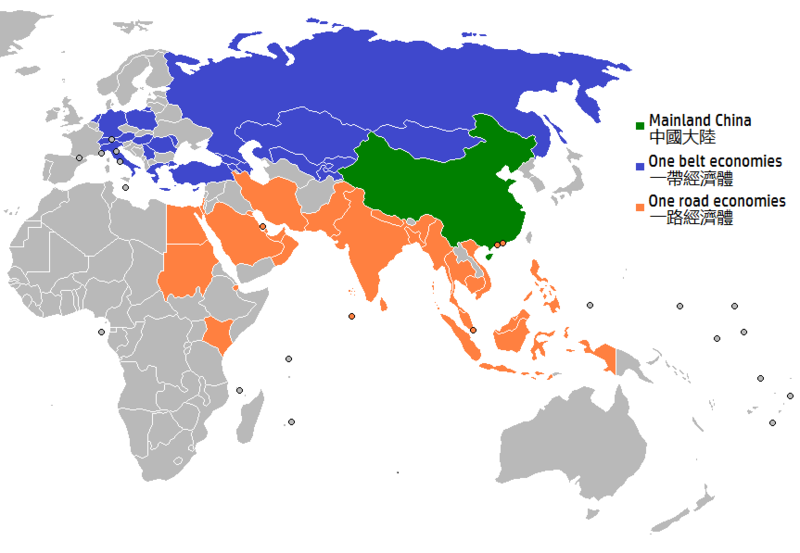

The perceived expansion of Xi’s power through the Belt and Road infrastructure project is undoubtedly another thorn in the side of foreign policy planners.

*****

One obvious problem this situation represents is for those caught in the middle; Washington’s traditional clients, especially in Europe. A recent survey shows that Germans are now almost equally divided on who represents a more important partner – Washington or Beijing? A significant shift over 2019 which put Washington 26 points ahead.

Although many Germans are unhappy about China’s handling of the Corona-Virus and have suspicions it could have been better handled they don’t wholesale blame all CCP for the chaos being wreaked around the world.

And while traditionally, the German attitude to the US usually reflects who is sitting in the white house the Trump administration’s current perceived mishandling of the crisis; increasing belligerence toward the CCP and the WHO; and the increasing calls for Europe to pay for its own defense are putting traditional allies in a difficult position.

If the U.S. escalates the current spat into a full-blown soft-reboot of the cold war it could find itself in a lonely place with former client states between a rock and a hard place.

****

More worryingly, a new Cold War between the U.S. and China could have a far larger global impact than that with the USSR.

China is far more economically powerful and technologically advanced than the Soviet Union was, and is catching up with the U.S. in other areas. That could make them dangerous rivals if some kind of accommodation can’t be reached and the world goes down that road.