The Thing about the Data

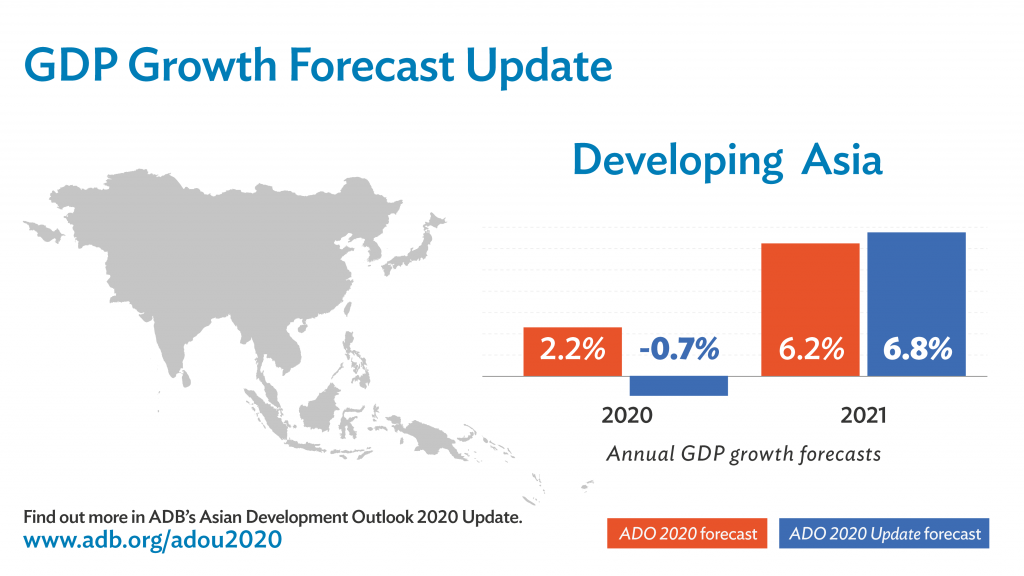

The Thing about the Data GDP

GDP GDP – the Asian Crisis and the 1998 Controversy

GDP – the Asian Crisis and the 1998 Controversy Freight Transport

Freight Transport Consumer Price Index (Inflation)

Consumer Price Index (Inflation) Balance of Payments

Balance of Payments Purchasing Manager's Index

Purchasing Manager's Index Foreign Currency Reserve Estimates

Foreign Currency Reserve Estimates Understanding China's Demographics

Understanding China's Demographics Understanding China's Real Estate Market

Understanding China's Real Estate Market Why China's Unemployment Figures Don't Add up

Why China's Unemployment Figures Don't Add up Understanding the Consumer Price Index

Understanding the Consumer Price Index Understanding China's Bond Market

Understanding China's Bond Market How SOE Re-structuring put the CPC in charge

How SOE Re-structuring put the CPC in charge Fixed Asset Investment

Fixed Asset Investment Markit Purchasing Managers Index

Markit Purchasing Managers Index Understanding Fiscal Revenue and Expenditure

Understanding Fiscal Revenue and Expenditure Industrial Value Added – How its calculated and why its important

Industrial Value Added – How its calculated and why its important Understanding China's Economic Geography

Understanding China's Economic Geography Understanding China's 3 Major Economic Hubs

Understanding China's 3 Major Economic Hubs Yangtze River Delta

Yangtze River Delta The Pearl River Delta (PRD)

The Pearl River Delta (PRD) Bohai Bay

Bohai Bay The Northwest

The Northwest China's Third Coast (the Yangtze)

China's Third Coast (the Yangtze) Central China

Central China The Southwest

The Southwest