To download the full report click here.

COVID SHOCK

Conditions in China and the rest of the world have changed dramatically over the last six months. The COVID-19 pandemic has taken a severe human toll, caused the deepest global recession in eight decades, and inflicted enormous damage on jobs and welfare worldwide.

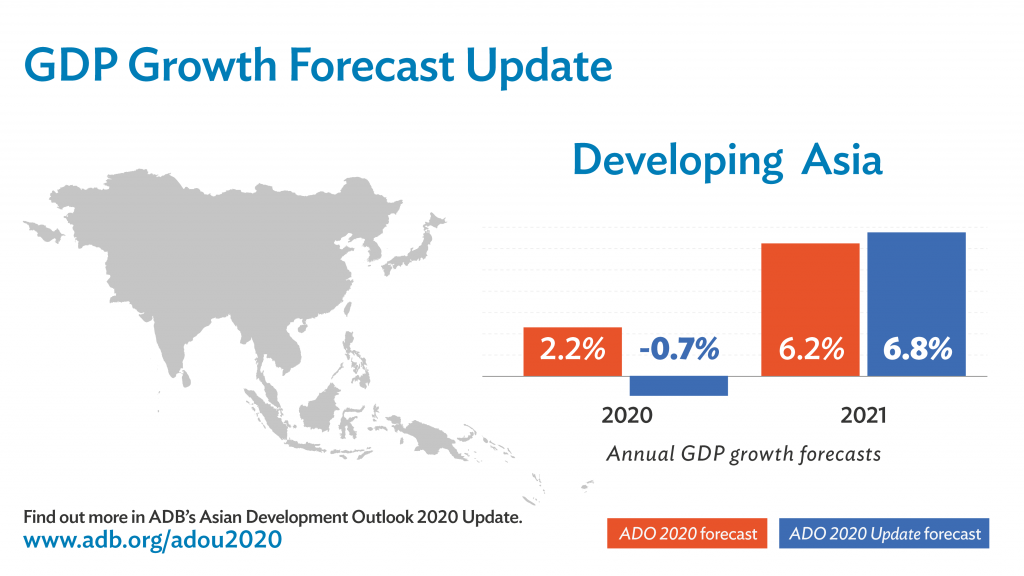

FORECAST

For China our baseline forecast envisions a sharp slowdown of growth to 1.6 percent this year, which would mark the slowest expansion since 1976. While supply side constraints have eased and economic activity has started to rebound, domestic and external demand remain fragile and restrain the pace of recovery, despite the swift measures taken to contain the economic fallout.

IMPACT

Even as economic activity rebounds, the shock is likely to leave the economy scarred. The pace of poverty reduction is expected to slow, reflecting labor dislocation and slower growth in household incomes. Our projections show that without additional policy measures, 8-20 million fewer people are projected to escape poverty in 2020, compared to the pre-pandemic scenario. Self-employed workers and those in less secure, informal jobs, particularly migrant workers, are being especially hard hit.

RISKS/POLICY

While risks are exceptionally high, they can be partially mitigated by good policies.

MONETARY.

Policy makers will need to ensure monetary and financial sector policies remain flexible to ensure abundant liquidity and keep market rates and bond yields low, easing the debt burden on households, firms, and governments. At the same time, financial risks should be managed carefully especially since the shock has further aggravated China’s debt levels, which were high even before COVID.

FISCAL/SOCIAL.

Fiscal policies would will need to play a critical role in supporting the recovery, and stimulus measures can should be designed in a way that contributes to achieving more inclusive, carbon-neutral and greener growth. The pandemic has amplified the need to close gaps in China’s social safety nets both to support distressed workers and households, and to help minimize lasting weakness of domestic consumption.

STRUCTURAL.

Accommodative macroeconomic policies to support demand could be accompanied by deeper structural reforms to stimulate a stronger, job-intensive recovery and to facilitate adjustment to the post-pandemic economy. Reforms to address barriers to labor mobility, including further liberalization of the Hukou system would facilitate movement of labor from firms and sectors suffering more persistent damage to expanding sectors, firms, and locations.

SUSTAINABLE AND INCLUSIVE RECOVERY

The pandemic shock has exposed deeply connected economic, social, and environmental fragilities, further increasing the urgency of achieving China’s objective of rebalancing the economy toward more inclusive, sustainable, and greener growth. The recovery offers an opportunity to accelerate progress towards these goals.