Lao-China Railway Could boost aggregate income by 21% according a recently released World Bank report. Part of China’s grand Belt and Road Initiative(BRI), the railway connecting Lao and later Thailand, Malaysia and Singapore to the ambitious BRI if the right reforms are undertaken by the Lao Government.

The 414km long stretch of the high-speed rail-network connecting the capital, Vientianeand Boten at the border with China could provide Lao with a land link to global and regional supply chains – making the country more attractive to investors and hence growth.

But for this to happen, the government is faced undertaking bold, and sweeping policy reforms to facilitate trade, improve connectivity and simplify rules around doing business. These reforms would make the country attractive as an investment destination and link it to major production and consumption bases – like China and the Association of South East Asian Nations (ASEAN) – allowing firms to access global value chains.

The report goes on to say that “With efficient logistics services, Lao PDR could develop into a logistics hub, while targeted investments in agriculture and tourism could result in new export opportunities.”

At present, the production costs of USD5.9bn (a bit more than a third of Lao’ GDP) are to be shared 30/70 with China paying the lion’s share. But the high costs presents major risks for a country as economically challenged as Laos.

Forty percent of construction will be funded through equity, with one-third provided by the Lao Government (partially funded through loans from the Export-Import Bank of China) and the remaining two-thirds funded by China. This 60 percent will be funded by loans from the Lao-China Railway Company, a State- Owned Enterprise with 30 percent Lao and 70 percent Chinese ownership.

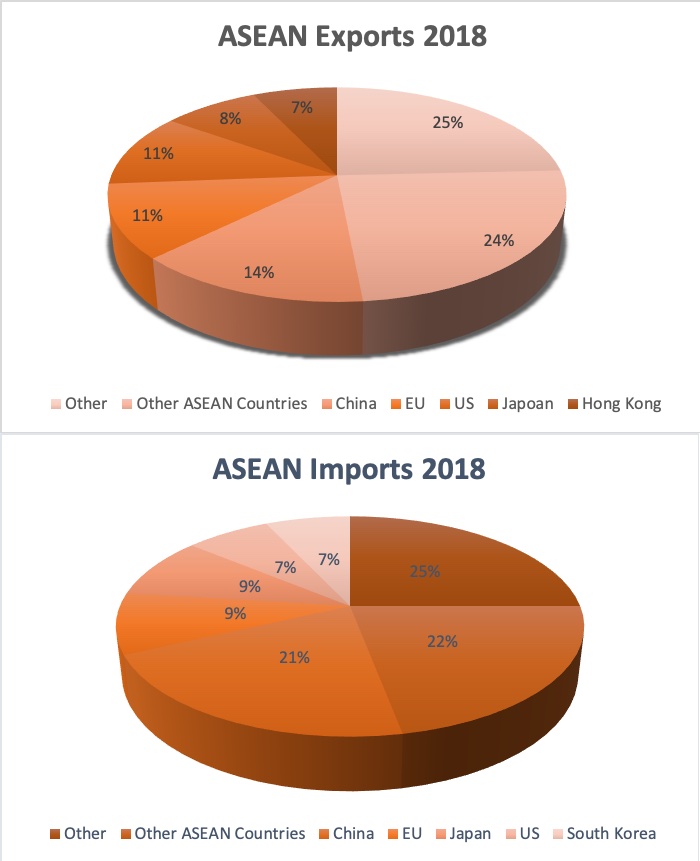

Success of the project will depend on China switching it’s current maritime cargo strategy to SE Asia and moving to rail. Most cargo destined for SE Asia is shipped and trade between China and Lao represents less than 2% of all China-ASEAN trades.

In 2019, China’s trade volume with ASEAN climbed by 14 percent to 4.43 trillion yuan. The EU remained China’s single largest trading partner with 4.86 trillion yuan in bilateral trade and an eight percent year-on-year growth rate (the U.S. has relegated to the third place on the list of China’s top trading partners with bilateral trade contracting more than 10 percent to around 3.73 trillion yuan).

(Source Eurostat)

The report estimates transit trade through the Laos railway corridor could reach an estimated 3.9 million tonnes per year by 2030, given a shift of 1.5m tonnes from the maritime transport sector.

Lao’s tourism industry could benefit greatly from an increase in demand for passenger rail traffic, which is expected to account for the majority of train traffic by 2030.

If Lao implements necessary logistics and trade reforms, the railway could attract traffic that is currently using maritime and air transport routes and significantly reduce land transport prices by 40-50 percent between Vientiane and Kunming, China and by 32 percent between Kunming and the Port of Laem Chabang in Thailand once the Lao-China railway starts to operate in December 2021.