Developing Asia will barely grow in 2020 as containment measures to address the coronavirus disease (COVID-19) hamper economic activity and weaken external demand, according to a new set of forecasts from the Asian Development Bank (ADB).

According to the report , excluding the newly industrialized economies of Hong Kong, China; the Republic of Korea; Singapore; and Taipei,China, developing Asia is forecast to grow 0.4% this year and 6.6% in 2021.

“Economies in Asia and the Pacific will continue to feel the blow of the COVID-19 pandemic this year even as lockdowns are slowly eased and select economic activities restart in a ‘new normal’ scenario,” said ADB Chief Economist Yasuyuki Sawada. “While we see a higher growth outlook for the region in 2021, this is mainly due to weak numbers this year, and this will not be a V-shaped recovery. Governments should undertake policy measures to reduce the negative impact of COVID-19 and ensure that no further waves of outbreaks occur.”

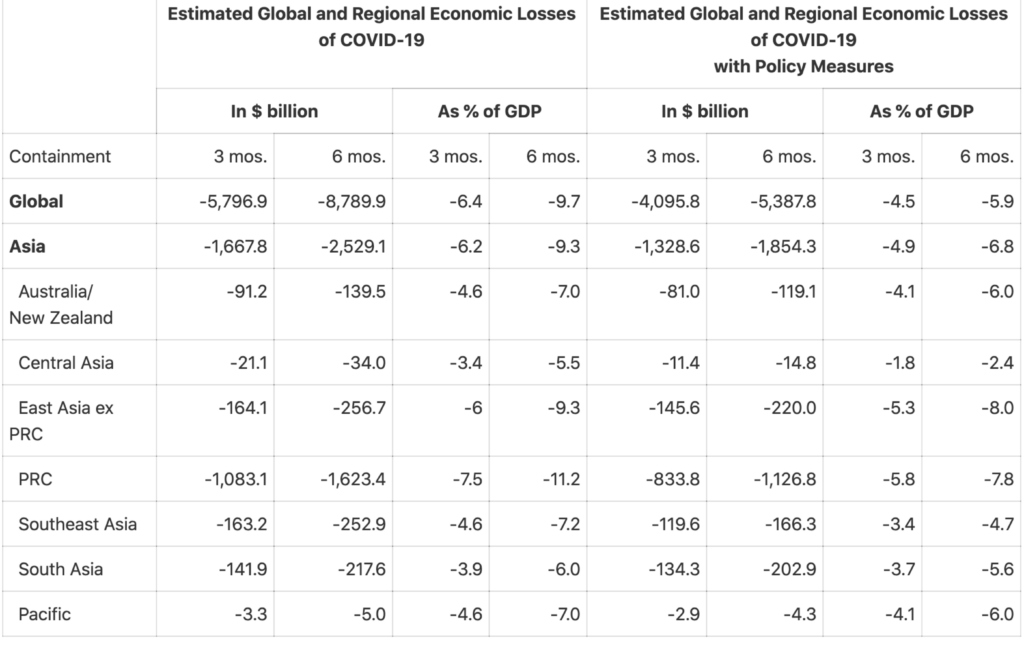

Risks to the outlook remain on the downside. The COVID-19 pandemic may see multiple waves of outbreaks in the coming period and sovereign debt and financial crises cannot be ruled out, the report goes on. There is also the risk of renewed escalation in trade tensions between the United States and the People’s Republic of China (PRC).

East Asia is forecast to grow 1.3% in 2020—the only subregion to experience growth this year—while growth in 2021 will recover to 6.8%. Growth in the PRC is forecast at 1.8% this year and 7.4% in 2021, compared to the April estimates of 2.3% and 7.3%, respectively.

Hit hard by COVID-19, South Asia is forecast to contract by 3.0% in 2020, compared to 4.1% growth predicted in April. Growth prospects for 2021 have been revised down to 4.9% from 6.0%. India’s economy is forecast to contract by 4.0% in fiscal year (FY) 2020, ending on 31 March 2021, before growing 5.0% in FY2021.

Economic activity in Southeast Asia is expected to contract by 2.7% this year before growing by 5.2% in 2021. Contractions are forecast in key economies as containment measures affect domestic consumption and investment, including Indonesia (-1.0%), the Philippines (-3.8%), and Thailand (-6.5%). Viet Nam is forecast to grow 4.1% in 2020. While that is 0.7 percentage points lower than ADB’s April estimates, it is the fastest growth expected in Southeast Asia.

Central Asia’s economic activity is expected to contract by 0.5% compared to the 2.8% growth forecast in April due to trade disruptions and low oil prices. Growth is forecast to recover to 4.2% in 2021.

Restricted trade flows and declining tourism numbers have dampened economic outlook for the Pacific subregion. The subregional economy is forecast to contract by 4.3% in 2020 before rising to 1.6% growth in 2021.